The Ultimate Guide To Lamina Loans

Wiki Article

The Ultimate Guide To Lamina Loans

Table of ContentsGet This Report about Lamina LoansThe Single Strategy To Use For Lamina LoansLamina Loans Things To Know Before You Buy9 Easy Facts About Lamina Loans DescribedThe Single Strategy To Use For Lamina LoansEverything about Lamina LoansA Biased View of Lamina Loans

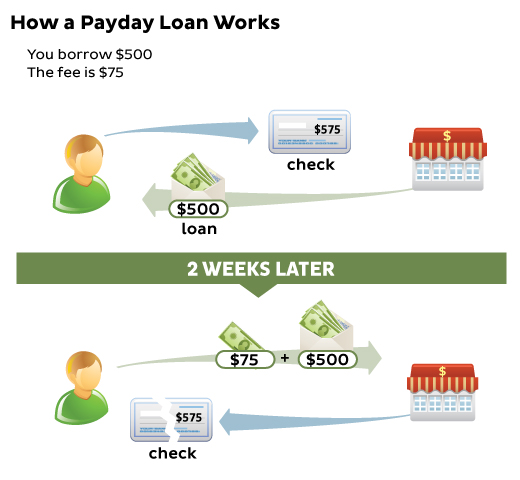

These lendings are generally for smaller sized amounts, varying from a few hundred to a couple of thousand dollars. Lots of states top the amount you can borrow with payday advance loan at $500. Payday advance loan expenses such as passion prices and charges can differ substantially. They're controlled by the state and also via the Customer Financial Defense Bureau (CFPB) - Lamina Loans.There may be various other threats as well as expenses to take into consideration based upon your personal situation and also the services and products being supplied. If you're not able to settle your lending, the lender might bill you late charges or other charges. The lender can send your financial debt to a debt collector or they may garnish your salaries.

A rollover, likewise described as a financing expansion or revival, enables borrowers to prolong their car loan though this isn't permitted in all states. Rollovers may give short-term alleviation, however they can quickly build up even more financial obligation and make it also harder to repay the loan. Most payday lenders do not report to the credit score bureaus, if you fall short to pay off the finance the debt may be sent out to collections.

Little Known Questions About Lamina Loans.

These car loans may also come with high rates of interest, but longer settlement terms expanded the expense right into smaller, more manageable bi-weekly or month-to-month payments. This kind of loaning can still be high cost, so make certain to very carefully read the terms and review your alternatives prior to deciding if this is right for you.This could be a cost savings account or certificate of down payment. The quantity you transfer will typically be your credit line (Lamina Loans). These kinds of credit scores cards can assist you build your credit report score with on-time payments and also they'll commonly have a lower rates of interest than a few of the other options. In some scenarios, it might be far better to obtain a tiny loan from a buddy or relative.

A title car loan is a funding in which an automobile works as collateral for the lending amount. If authorized, you get to maintain driving your car! Title finances at ACE Cash Express are supplied just in-store. The availability of financings and also the lending amount provided differs for each and every state where we offer title lendings.

The smart Trick of Lamina Loans That Nobody is Discussing

You can apply for a title loan in-store in Arizona, Louisiana, Oregon, select Tennessee shops, and also Texas shops (not supplied in Austin, Ft Worth, or Dallas). In Arizona, you may additionally have the ability to get a registration financing. Maximum lending amounts vary by state. If approved, your loan quantity will differ depending upon your income as well as typical underwriting criteria.If accepted, you get the cash, as well as you get to keep driving your lorry. Yes, title financings are readily available for bikes in-store, and the needs are the same as for title loans.

Excitement About Lamina Loans

(8%-10%); personal loans (14%-35%) and also on-line financing (10%-35%). Should payday financings also be thought about an option? Some states have broken down on high rate of interest rates to some degree.For $500 lendings, 45 states as well as Washington D.C. have caps, yet some are pretty high. The median is 38. 5%. However some states don't have caps whatsoever. In Texas, interest can go as high as 662% on $300 obtained. What does that mean in genuine numbers? It implies that if it you pay it back in 2 weeks, it will cost $370.

Incidentally, five months is the typical amount of time it takes to repay a $300 payday advance, according to the Seat Philanthropic Trusts. Before you get hold of at that quick, extremely pricey cash, recognize what payday financings require. The Customer Financial Security Bureau presented a series of guideline adjustments in 2017 to aid secure debtors, consisting of compeling cash advance lending institutions what the bureau calls "small buck loan providers" to establish if the customer could afford to tackle a lending with a 391% rate of interest, called the Necessary Underwriting Guideline.

4 Simple Techniques For Lamina Loans

A lender can not take this contact form the customer's cars and truck title as collateral for a car loan, unlike title car loans. A lender can't make a finance to a consumer that already has a short-term car loan. The lending institution is limited to prolonging finances to borrowers who have actually paid at the very least one-third of the major owed on each extension.

If a consumer can't repay the car loan by the two-week target date, they can ask the lender to "roll over" the car loan. If the consumer's state allows it, the borrower simply pays whatever fees schedule, and the lending is prolonged. The interest grows, as do finance costs. For example, the average cash advance finance is $375.

The Ultimate Guide To Lamina Loans

25 for an overall funding quantity of $431. 25. If they selected to "roll over" the payday advance loan, the brand-new quantity would certainly be $495. 94. That is the quantity obtained $431. 25, plus money fee of $64. 69 = $495. 94. That is how a $375 finance comes to be almost $500 in one month.The ordinary passion or "financing cost" as cash advance lenders refer to it for a $375 loan would be between $56. State regulations control the maximum passion a cash advance loan provider may bill.

If you used a charge click to read card instead, also at the highest possible credit history card price available, you are paying much less than one-tenth the quantity of passion that you would on a payday advance. Studies suggest that 12 million American consumers get payday advance loans annually, in spite of the ample proof that they send out most consumers into deeper financial obligation.

Lamina Loans Fundamentals Explained

Area companies, churches as well as private charities are the easiest locations to attempt. Numerous firms use workers a possibility to get cash they gained before their income schedules. For instance, if a staff member has actually worked seven days and also the next scheduled income isn't due for an additional 5 days, the firm can pay the worker for the 7 days.Report this wiki page